Actuarial Risk Modelling for Nature-Based Investment

We quantify uncertainty in nature-based projects so that investors can commit, developers can plan, and insurers can price.

The Challenge

Nature-based projects operate across decades under ecological, climatic, and market uncertainty. Yet investment decisions are typically informed by deterministic projections and qualitative risk narratives that obscure more than they reveal. Buffers are conservatively oversized. Insurance markets lack an actuarial evidence base. Capital allocation remains constrained not by a shortage of opportunity, but by a shortage of credible risk quantification.

Our Approach

Actuarial science developed to quantify risk where outcomes are uncertain, long-dated, and driven by interacting systems — precisely the conditions nature-based investment presents.

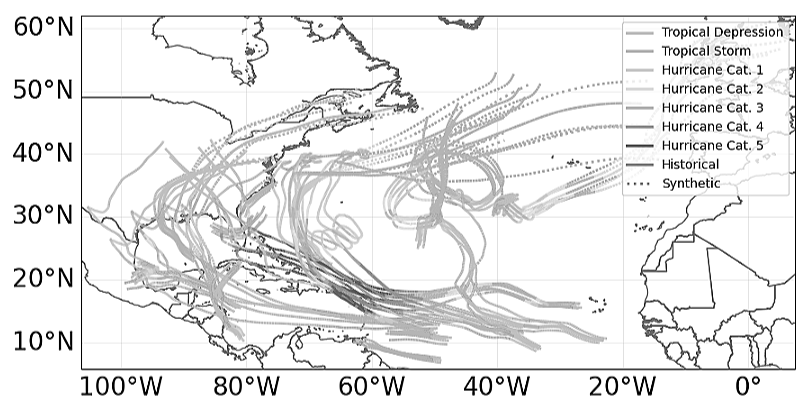

We build stochastic financial models that couple ecological process drivers with project economics within a single probabilistic framework. Risk drivers — whether acute events such as wildfire or disease, or chronic processes such as drought persistence and carbon price evolution — are selected, calibrated to empirical data, and propagated through to financial outcomes. The result is a transparent characterisation of the full distribution of project performance, not a single forecast.

Model architecture and complexity are determined by the risk profile of each project. We are methodology-agnostic — we fit the analytical framework to the decision being made.

Who We Serve

Investors

Independent, quantitative risk characterisation structured for investment committee decision-making. We deliver probability distributions of return, identification and assessment of material failure modes, and sensitivity analysis across key drivers — providing the due diligence depth required before capital is committed.

Project Developers

Robust financial projections grounded in stochastic modelling rather than deterministic assumptions. We help developers understand the risk-return profile of their project early, stress-test financial structures, and present credible, defensible projections to capital providers and credit buyers.

Insurers & Risk Transfer

Quantitative assessment of ecological and permanence risk that supports underwriting research, due diligence, and parametric product development. Our analysis provides the actuarial foundation for replacing inefficient buffer pools with financial risk management — enabling more capital-efficient project structures aligned with emerging ecological insurance models.

About

Ecometry is an independent UK-based consultancy operating at the intersection of actuarial science, ecological modelling, and climate finance. We do not develop projects, transact credits, or represent registries — our sole function is rigorous, transparent risk quantification.

Dr Roger Iles — Founder

PhD Astrophysics, University College London | Reinsurance solvency and capital modelling, SCOR | Climate risk quantification, Vivid Economics / McKinsey | Ocean Voice, Marine Conservation Society